Gazelles in Myanmar and Cambodia

This post about business “gazelles” is based on EMC Consulting’s 2018-19 work for the Dutch Good Growth Fund (DGGF) ‘Investment Fund Local SMEs’, an initiative of the Dutch Ministry of Foreign Affairs. The study was commissioned to better understand the ‘missing middle’ in the Mekong region – those businesses that have outgrown microfinancing but do not yet have access to conventional financial services. We used the ANDE framework for analysing countries’ entrepreneurial ecosystems. In-depth country studies were undertaken in Cambodia, Lao PDR, Myanmar and Vietnam.

“Gazelles” are defined as high-growth, medium-sized businesses (more than 20% growth of annual turnover and 20 to 99 employees). In Myanmar, they account for only 4% of all small and medium sized businesses; in Cambodia they account for 8%.

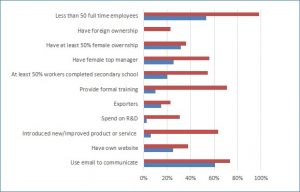

EMC Consulting analysis of World Bank Enterprise Survey data found that gazelles in Myanmar differ in many aspects from those in Cambodia. In Myanmar, more Gazelles employ more than 50 workers than in Cambodia. A Gazelle in Myanmar is less likely to have foreign or female ownership, and be female-managed. Workers at Myanmar’s Gazelles are less educated than those in Cambodia, and their employer is less likely to provide them with formal training. Fewer of Myanmar’s Gazelles are exporters, and they tend to be less innovative and tech savvy.

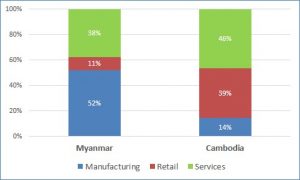

These differences likely result – at least in part – from Myanmar’s larger domestic market and long period of isolation, which demanded greater self-sufficiency. For example, Gazelles in Myanmar are much more likely to be manufacturers than those in Cambodia, a much smaller and more open market. In Cambodia they tend to be in retailing or other services.

For more information on SMEs in Myanmar and Cambodia (as well as Lao PDR and Vietnam) see our post on characteristics of SMEs’ in the Mekong region. We also analysis their use of financial products. See also our analysis of obstacles faced by SMEs in the Mekong countries.

Comments are closed.