SMEs’ use of finance – CLMV

As part of our work for the Dutch Good Growth Fund #ClosingTheGap series, we analysed 2016 data from the World Bank’s Enterprise Surveys to paint a nuanced picture of small and medium-size enterprises (SMEs) in Cambodia, Lao PDR, Myanmar and Vietnam. SMEs are not a homogeneous group. Hence their finance and development needs are different.

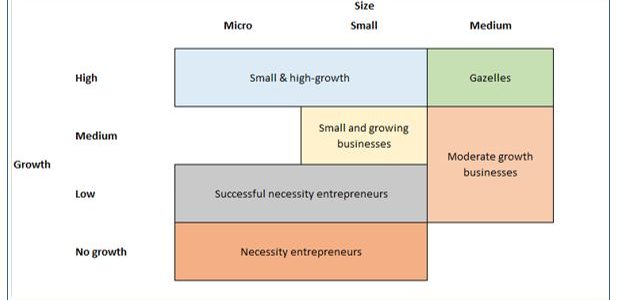

SMEs’ use of financial services differs not just across the four countries, but according to the type of SME. We segment SMEs according to their size and growth into a number of categories:

We then examine the use of financial services by each SME category in the four countries.

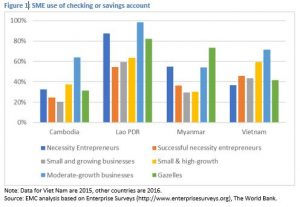

Bank accounts

In most of the countries, the majority of SMEs do not have a checking or saving account. However, larger and faster-growing SMEs are generally more likely to have an account.

Loans

Similarly, most SMEs do not have a bank loan, but larger and/or faster-growing SMEs are typically more likely to have an account.

Funding investment

Very few SMEs use banks or non-bank financial institutions (such as MFIs) to finance their investments. Most investment is funded internally.

Related posts include Mekong SMEs’ use of financial products. We also examine obstacles faced by SMEs in the Mekong countries, and provide further detail on their financing challenges.

The Dutch Good Growth Fund/financing local SMEs is a “fund of fund” investment initiative from the Dutch Ministry of Foreign Affairs that aims to improve financing for the “missing middle” – i.e. entrepreneurs who have outgrown micro-finance but do not yet have access to conventional capital markets.

The Seed Capital and Business Development program aims to further the impact of DGGF by providing technical assistance , seed capital and business support services to intermediary funds and local SMEs. In addition, the program incorporates a knowledge development and sharing component that supports research, tests assumptions and shares insights on financing SMEs in developing countries and emerging markets – fostering industry-wide knowledge exchange.

The #ClosingtheGap series aim to improve common understanding of key challenges faced by entrepreneurs, notably the “missing middle” in the countries covered by the DGGF mandate. They are a tool to to facilitate and support local and international stakeholder’s efforts in setting the agenda in terms of SME development.

In-depth country reports are available for Cambodia, Lao PDR, Myanmar and Vietnam.

Comments are closed.