Cambodia’s SMEs

As part of our work for the Dutch Good Growth Fund #ClosingTheGap series, we have analysed 2016 data from the World Bank’s Enterprise Surveys to paint a nuanced picture of Cambodia’s small and medium-size enterprises (SMEs). SMEs are not a homogeneous group. Hence their financing and development needs are different.

Finding the Gazelles

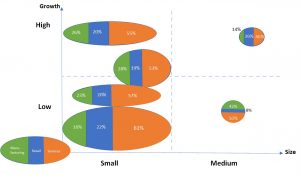

Segmenting Cambodia’s SMEs by size and growth highlights that the majority are small and low-growth (“necessity entrepreneurs”), but a small number are larger and faster-growing (“Small growing businesses” and “Gazelles”).

Source: EMC analysis based on Enterprise Surveys (http://www.enterprisesurveys.org), The World Bank.

Women ownership of Cambodia’s SMEs

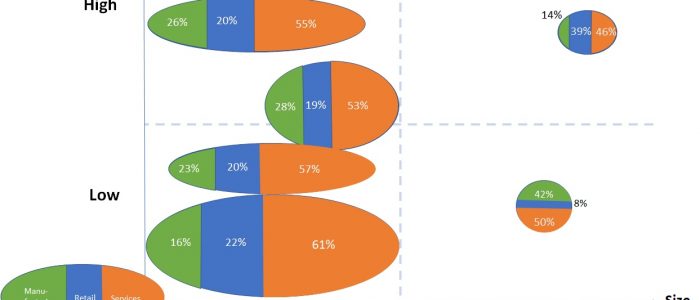

Many of these businesses are owned by women:

Source: EMC analysis based on Enterprise Surveys (http://www.enterprisesurveys.org), The World Bank.

SMEs by Sector

Smaller businesses tend to be in retailing. Not surprisingly, manufacturers tend to be larger.

Source: EMC analysis based on Enterprise Surveys (http://www.enterprisesurveys.org), The World Bank.

Cambodian SMEs’ characteristics

Looking at the businesses’ characteristics highlights further differences.

Where are they?

While Phnom Penh is home to the majority of SMEs, they are well-represented throughout the country. Large businesses are far more likely to be in Phnom Penh.

Business Obstacles

Different businesses face different obstacles, and these have changed over time. Hard infrastructure, particularly electricity, used to be the most-cited top business constraint in Cambodia. More recently, competition from the informal sector has emerged as the major concern of businesses:

Women entrepreneurs sometimes face different constraints than men (see more on gender here):

For more information on SMEs in the Mekong region see our post on their characteristics. We also analysis SME’s use of financial products. See our analysis of obstacles faced by SMEs in the Mekong countries.

The Dutch Good Growth Fund/financing local SMEs is a “fund of fund” investment initiative from the Dutch Ministry of Foreign Affairs that aims to improve financing for the “missing middle” – i.e. entrepreneurs who have outgrown micro-finance but do not yet have access to conventional capital markets.

The Seed Capital and Business Development program aims to further the impact of DGGF by providing technical assistance , seed capital and business support services to intermediary funds and local SMEs. In addition, the program incorporates a knowledge development and sharing component that supports research, tests assumptions and shares insights on financing SMEs in developing countries and emerging markets – fostering industry-wide knowledge exchange.

The #ClosingtheGap series aim to improve common understanding of key challenges faced by entrepreneurs, notably the “missing middle” in the countries covered by the DGGF mandate. They are a tool to to facilitate and support local and international stakeholder’s efforts in setting the agenda in terms of SME development.

In-depth country reports are available for Cambodia, Lao PDR, Myanmar and Vietnam.

Thank you very much for publishing this useful data on the SMEs in Cambodia.

Do your organization have any update information about SMEs in Cambodia to be shared?

Appreciate to have such possible latest information on Cambodia SMEs.

Kind regard,