Estimating the Market Size for New Products

Quantifying the market size, and other demand factors, for new products and services is important for both firms and development partners.

This blog post focuses on EMC work to identify key market segments, total demand and buying behaviour for a new ‘advanced cookstove’, introduced by SNV. However, this new product costs approximately twenty times more than the traditional cookstoves commonly available in local markets. So, for a successful introduction it was critical to understand how many consumers could afford such a product, why they would buy it, and how to optimise adoption.

Our findings were used to design commercial stove and fuel distribution; household financing options; and demand creation activities. This lead to establishment of a social enterprise to assemble and distribute the stoves in Cambodia. It aims to serve 15,000 households by late 2021 with a new product to Cambodia that is cleaner, healthier, more energy efficient, and safer than traditional cookstoves.

How we did it

Initially, EMC researched relevant literature, as well as interviewing some key informants to identify the likely customer base. National household data was then used to segment the population and quantify key target customer groups. A household survey was then conducted, as well as focus group discussions. Analysis of these data were used to validate and profile the target market segments, estimate the size of the potential market and informed our recommendations to the client.

Segmentation

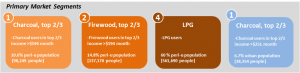

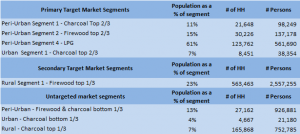

The potential market for the new product was segmented by geography, income, and current fuel type usage. Nine segments were created. The Cambodia Socio-Economic Survey was a primary source of information for this. We used attractiveness criteria to narrow these to 3 primary and 3 secondary target segments for the cookstove.

Surveys and focus groups

Based on the above desk research and key informant interviews, a household survey was designed. Much of the survey was devoted to gathering information for defining the market size, target groups and segments. The remaining sections of the survey were focused on gathering insights into user acceptability, willingness, barriers to adoption, pricing, subsidies and payment options.

The sample for the survey was households in the target segments. 313 households were surveyed. These included urban, peri-urban, and rural households. The survey respondent was the person primarily responsible for cooking in the household and therefore the likely end user of the cookstove. 99% of respondents were female.

Next, 4 focus group discussions were held (3 consisting of primary target markets and 1 low-income peri-urban group with some interest in the cookstove). These sessions included a product demonstration. These provided some insights deeper than obtained by the survey.

Analysis

Our analysis was broken into four parts:

- Validating the initially-identified market segments

- Profiling target market segments

- Understanding motivations and barriers

- Analysis of affordability

- The survey data was used to validate all the above the market segments on the basis of: desired ownership, willingness to pay, ability to pay, and willingness to use financing methods. From this, the four highest-potential markets were identified as targets.

- Each segment was analysed and profiled, including their interest in owning the cookstove, their income and willingness to pay, affordability and preferred financing methods, and their motivations and barriers to changing cookstove.

- Historic patterns of product purchases and behaviour change were examined. EMC analysed the advantages and disadvantages of competitor stoves. Using our survey data, our client’s product was compared with competitors on price, fuel cost savings, ease of use, safety, and robustness.

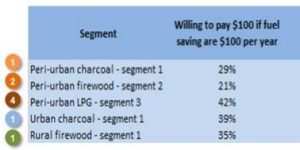

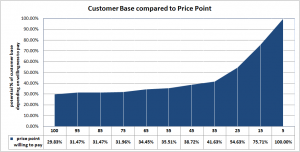

- The willingness of respondents to pay the $100 price for the product was analysed. We also explored price discovery below the $100 price tag (the willingness to pay of those who would not buy at $100), and evaluated price points for each target segment. Finally, the impact of financing methods on desire to purchase the cookstove were examined.

So how big is the market?

The actual population numbers relating to each target segment were extrapolated from Cambodia Socio-economic Survey data.

EMC estimated a total market size (primary target segments) of 184,090 households. Based on our willingness to pay data, the total addressable market was estimated at 64,500 cookstove units ($64.5m).

Other market insights

- Target households are open to change. 60-80% of respondents have changed stove (albeit at very low cost). They are also open to new technologies (for example, 49% of respondents own a rice cooker, at a change cost of $22)

- Fuel cost savings from the client’s product are significant for some target segments. These should form part of the marketing message.

- The willingness to pay, and hence potential market, increases substantially at a significantly lower price.

Hence, discussion with households of financing methods (installment scheme and microfinance) increased respondents’ desire to purchase the cookstove from 27% to 66%. Creative pricing plans are therefore important factors in making the purchasing decision and could significantly increase sales.

Based on our findings, EMC provided the client with recommendations around which consumers to target, what to include in marketing messages, pricing plans and other issues. Our Final Report is here.

The social enterprise that emerged from this project is now run by C-Quest Capital.

Related EMC posts include:

Myanmar cookstove market assessment

Rice husk gasifiers in Cambodia

For more information on SNV’s work in the area of cookstoves:

https://snv.org/project/sustainable-biomass-fuels

https://snv.org/project/market-acceleration-advanced-clean-cookstoves-greater-mekong-sub-region

Comments are closed.