Financial and environmental returns to energy efficiency

The financial returns to cost-saving investments are of interest to all businesses, as well as finance providers and development partners. EMC provided our client with quantitative conclusions despite limited local data when we estimated the returns to energy efficiency solutions.

This is a continuation of our previous blog post (see here), on how we estimated the returns. The previous post detailed our approach. Here we present the results of our analysis. This analysis was then used to design a Fund to support SMEs’ investments in energy efficiency solutions.

Note: the estimates below reflect data available in 2016 and may no longer be valid.

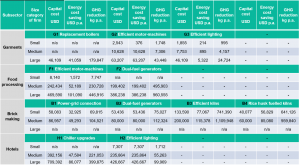

EMC estimated of the financial and environmental returns to investing in energy efficiency (EE) solutions for Cambodian businesses (in four selected industries). Our results are summarised in the table below. We show the savings for each EE solution in each industry.

Financial returns to energy efficiency

For each EE investment we calculated the capital cost and any incremental O&M costs. Then we estimated the energy cost savings (kWh pa savings were converted to $ using the cost/kWh for various energy sources and the changing mix pre and post the EE solution).

For each EE solution we calculated its net cash flow over a given forecast period (up to 15 years). From these we obtained IRRs, payback periods, and other financial metrics. Cash flow forecasts for each solution were produced pre- and post-financing. Our post-financing analysis assumed 100% of the capital cost is financed by debt. We calculated the debt service coverage ratio for each year of our forecasts (using an assumed market interest rate). We also produced a debt schedule and EE cashflow statement (for each solution and then for the business overall).

Our estimates of the financial returns from investing in energy efficiency are summarized here:

Thus, the financial returns are significant, particularly for three of the industries.

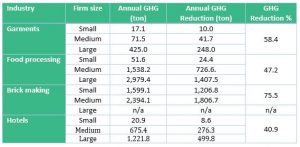

Environmental returns

In addition to the financial returns to the businesses, the greenhouse gas reductions are also significant. They total the equivalent of 41% (hotels) to 76% (brick makers) of the average business’s emissions, as detailed in the table below.

To obtain these GHG estimates we used a standard formula for calculating the carbon dioxide-equivalent. This is a quantity that describes, for a given mixture and amount of greenhouse gas, the amount of CO2 that would have the same global warming potential (GWP).

Our full methodology to obtaining these results is detailed in our previous blog post.

Energy efficient technology helps improve competitiveness and the environment. Other EMC blog posts describe the relevant institutional environment in Cambodia, and the energy mix in Cambodian industry.

Other related EMC posts:

Challenges with Rice Husk Gasifiers in Cambodia

Select relevant reports from our client and their knowledge platform:

The Economic, Social and Environmental Impacts of Greening the Industrial Sector in Cambodia

Cambodia’s Green Growth Potential

Financial Policy and Regulatory Barriers to Private Climate Finance in South-East Asia

Comments are closed.