SMEs in the Mekong Region are not all alike

This post is based on EMC Consulting’s 2018-19 work for the Dutch Good Growth Fund (DGGF) ‘Investment Fund Local SMEs’, an initiative of the Dutch Ministry of Foreign Affairs. The study was commissioned to better understand the ‘missing middle’ in the Mekong region – those SMEs that have outgrown microfinancing but do not yet have access to conventional financial services. We used the ANDE framework for analysing countries’ entrepreneurial ecosystems. In-depth country studies were undertaken in Cambodia, Lao PDR, Myanmar and Vietnam.

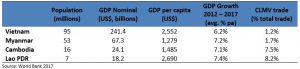

Mekong Countries – Key facts

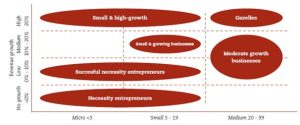

Types of SMEs

Not all small and medium enterprises (SMEs) are alike. In order to better understand the characteristics of SMEs in each country, EMC Consulting segmented World Bank Enterprise Survey data according to businesses’ number of employees and revenue growth.

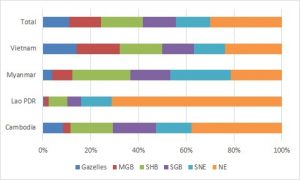

Across all four countries, (successful) necessity entrepreneurs account for the largest proportion of SMEs. As the region’s most developed country, Vietnam has the highest proportion of Gazelles and moderate-growth businesses, followed by Cambodia and Myanmar. Lao PDR has by far the largest proportion of necessity entrepreneurs, reflecting its overwhelmingly rural and microbusiness-based economy.

Comparing SMEs

EMC Consulting analysis of 2016 Enterprise Survey data (the latest then available) found the following features of each type of SME:

Necessity Entrepreneurs (NE)

- Typically have six to eight full-time employees.

- About half are female owned, except Myanmar, which counts 28%.

- The majority are in services (>50% in all four countries), but they are generally more likely to be in Retail than other types of SMEs.

- Almost none export, except in Vietnam where 11% of them do.

- They don’t invest in R&D.

Successful Necessity Entrepreneurs (SNE)

- Typically have fewer than 10 full-time employees, except in Vietnam where 60% have 10 or more.

- Majority are female-owned in Cambodia and Vietnam, but not in Lao PDR and Myanmar.

- The majority are in services (>45% in all four countries). More are in manufacturing than are NEs (except in Myanmar).

- Although few export, more SNEs are exporters than NEs, SGBs and SHBs, except in Lao PDR.

- They generally don’t invest in R&D.

Small Growing Businesses (SGB)

- Typically have fewer than 10 full-time employees, except in Vietnam where 60% have 10 or more.

- Half are female-owned, except in Myanmar where 30% are.

- About 20% are in Retail, except Myanmar where 40% are. In Cambodia and Lao PDR, about a third are in Manufacturing, where in Myanmar and Vietnam only about 10% are.

- Very few export.

- In Cambodia and Lao PDR, more invest in R&D than do NEs and SNEs. But not in Myanmar and Vietnam.

Small, High-Growth Businesses (SHB)

- Typically have fewer than 10 full-time employees, except in Vietnam where 63% have 10 or more.

- About half are female-owned, except Vietnam where 40% are.

- Most are in Services (>53% in all four countries). In Cambodia and Lao PDR, fewer are in Manufacturing than SGBs.

- Less likely than SNEs and SGBs export.

- In Vietnam and Cambodia, more invest in R&D than NEs, SNEs and SGBs.

Moderate-Growth Businesses (MGB)

- On average have 32 full-time employees. 20% have more than 50 full-time employees.

- Majority (about 70%) are male-owned, except in Vietnam where 53% are female-owned.

- Half are in services, and MGBs are much more likely to be in Manufacturing than NEs, SNEs, SGBs and SHBs (except in Lao PDR).

- Although only a minority export (between 12% and 23%), significantly more do than NEs, SNEs, SGBs and SHBs.

- Much more likely to invest in R&D than NEs, SNEs, SGBs and SHBs.

Gazelles

- Higher number of full-time employees than other types of SME, except in Cambodia where MGBs are bigger.

- Female ownership rates are lower than some other types of SME (Lao PDR 23%, Myanmar 32%, Cambodia 36%, Vietnam 43%).

- Less than half are in Services, except Vietnam where 67% are in Services. In Myanmar and Laos, much more likely to be in Manufacturing than other SMEs.

- Generally more likely to export than other SMEs.

- More likely to invest in R&D, except Lao where MGBs are more likely.

Related posts include Mekong SMEs’ use of financial products. We also examine obstacles faced by SMEs in the Mekong countries, and provide further detail on their financing challenges. A comparison of Gazelles in Myanmar and Cambodia can be found here.

Comments are closed.