Borrowing capacity of Cambodian businesses

Although access to finance is oft-cited as a constraint on small and medium business, many Cambodian companies do have at least moderate borrowing capacity.

This blog post is part of our work to design a Fund that would assist Cambodian SMEs invest in improved energy efficiency. In order to help determine the potential size of the Fund, the borrowing capacity of businesses was assessed.

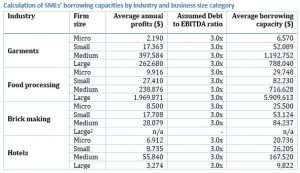

This borrowing capacity assessment was undertaken using micro-data from the 2014 Cambodian Inter-Censal Economic Survey (CIES) produced by the National Institute of Statistics of Cambodia. Businesses were classified into “micro”, “small”, “medium” and “large” for each of our chosen industries, reflecting number of employees at these firms.

One of the key credit metrics used internationally by lenders is the earnings gearing ratio, or debt-to-EBITDA ratio.[1] Based on average metrics for industrial companies rated by S&P, a debt-to-EBITDA ratio of around 2.5 to 3.0 would represent gearing broadly in line with an investment-grade credit profile.

Multiplying firms’ average annual EBITDA results by 2.5 to 3.0 would therefore provide an indication of borrowing capacity, assuming SMEs intend to maintain a moderate financial risk profile.

However, CIES data does not include EBITDA values. To approximate, we used SMEs’ average annual profits as the closest available data point, and applied the upper bound of the debt-to-EBITDA metric of 3.0. Results are shown in table below.

For the purposes of our Study, three subcategories were excluded from subsequent analysis: those having annual profits under US$8,000. This profit cut-off was selected to balance our objectives of maximising accessibility to the Fund with the need to limit micro-loan sizes in order to manage overall transaction costs. In practice, we would expect some SMEs in these groups to have profits above the cut-off level and be able to borrow.

The analysis above shows that businesses’ borrowing capacity ranges from approximately US$25,500 for micro brick makers, to US$5.9 million for large food processers. This in turn implies a wide range of capabilities of businesses to invest in cost saving measures (such as energy efficiency).

It is our understanding, through market discussions, that CIES data under-represents profitability and therefore the borrowing capacity as calculated likely represents a lower bound. We note also that some SMEs have existing loans outstanding. Hence our estimates of borrowing capacity do not measure potential for additional debt, but rather the total.

—

In addition to the above debt capacity, EMC analysis of energy efficiency investments shows there are many investments that are affordable – within SME debt capacity – and profitable – pay for themselves within short period.

[1] EBITDA = earnings before tax, interest expenses, depreciation and amortisation. It is often used by lenders as a proxy for cash flow.

Comments are closed.