The Financing Gap Faced by SMEs

This post on the financing gap is based on EMC Consulting’s 2018-19 work for the Dutch Good Growth Fund (DGGF) ‘Investment Fund Local SMEs’, an initiative of the Dutch Ministry of Foreign Affairs. The study was commissioned to better understand the ‘missing middle’ in the Mekong region – those businesses that have outgrown microfinancing but do not yet have access to conventional financial services. We used the ANDE framework for analysing countries’ entrepreneurial ecosystems. In-depth country studies were undertaken in Cambodia, Lao PDR, Myanmar and Vietnam.

The availability of financial services for SMEs in the Mekong region varies a great deal from country to country, especially in terms of credit, investment and the role of government.

| Banks | Banks are well-represented in each country. However, they tend to serve larger corporate clients and operate in larger urban areas. Banks can cover only a small part of the investment needed by SMEs. |

| Microfinance Institutions (MFIs) | MFIs vary a lot across countries. Cambodia has the most extensive network, and MFIs are increasingly a viable finance alternative for SMEs. In other countries, MFI networks and loan sizes are limited due to regulation. |

| Government SME Credit | The governments of Vietnam, Lao PDR and Myanmar are more involved in the provision of finance to SMEs, reflecting a history of state control. The Cambodian government by contrast has very limited direct involvement in the provision of financial services and therefore financial support for SMEs. |

| Leasing | Leasing is growing in each country, though in Lao PDR and Cambodia, much is focused on consumption and not financing SME investment. There is a lack of asset finance across the region. |

| Private Equity | Reflecting its larger economy, PE is most developed in Vietnam[1], followed by Cambodia and Myanmar. There are no investment managers based in Lao PDR. |

| Venture Capital | Tech-oriented VC is similarly strongest in Vietnam, followed by Myanmar, which benefits from close ties to Singapore’s VC community. Cambodia is catching up fast, with several launches in the past two years. |

| Angel Investors | Angel networks in Vietnam are developing due to higher quality startup community, but still fragmented. In Myanmar and Cambodia these will emerge gradually, as the ecosystem graduates more investible startups. |

Similarly, firms’ rankings for their ‘access to finance’ vary considerably across countries and by type of SME, so it is difficult to draw conclusions. Access to finance is a relative factor that may be significantly impacted by other constraints that are not directly related to demand and supply of credit.

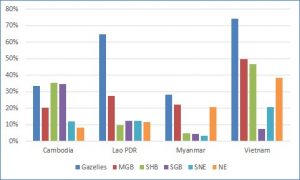

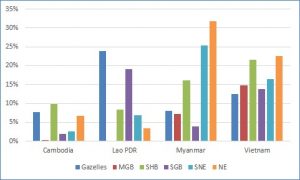

According to 2016 Enterprise Survey data, Vietnamese SMEs are more likely than the other countries to view access to finance as their biggest constraint (see figure below), although Vietnamese SMEs are more likely than other SMEs in other countries to use finance. The opposite is true of Cambodian SMEs: they have relatively low access to bank loans or lines of credit yet are less likely to report access to finance as a constraint. In Myanmar and Vietnam, slower growth and smaller firms are more likely to report ‘access to finance’ as their biggest constraint, while in Lao PDR it is larger, faster-growing firms that see it as an issue.

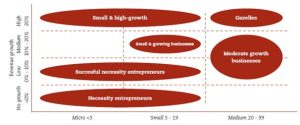

Note: In the above figure we divide SMEs into six types, depending on their size and growth. This segmentation is explained in this diagram:

These differences in financing are indicative of the high level of variation between the entrepreneurial ecosystems, both in terms of SMEs’ level of development and the sophistication of the financial sector in each country.

In terms of credit, the high level of market penetration in Cambodia is driven by MFIs: excluding the banks that used to be MFIs, other banks have on average just 10 branches.[2] The majority of Cambodian MFIs have transitioned to private sector ownership, whereas in Vietnam, Myanmar and Lao PDR the sector is mainly under government or development sector control and operated for poverty alleviation.

In general, SMEs do not make significant use of loans or a line of credit, though those that do are usually larger and growing faster (see figure below). Similarly, faster-growing and larger firms are more likely to use banks or non-banking financial institutions (NBFIs) to finance working capital or investment. SMEs generally deploy these finances to working capital rather than investment, which they are more likely to finance internally. Given that SMEs operate in an uncertain environment and lack the ‘ability to acquire finance’, this may be sensible: they can be reluctant to acquire debt that they may not be able to pay off, particularly because almost all loans require immovable assets as collateral.

Vietnamese businesses are generally more likely to have a bank loan or line of credit than those in the other countries, and within Vietnam, it is the larger and/or faster-growing businesses that are more likely to have a loan.

Proportion of SMEs with a loan or line of credit

With respect to the supply of risk capital, there are substantial differences. Vietnam is attractive to domestic and foreign investment managers, thanks to its large and sophisticated economy that offers more opportunities and greater growth potential. Lao PDR, in contrast, fares the worse: it has a smaller, less diverse economy, in which SMEs face growth challenges and consequently attract less interest from both domestic and external investors. Both Myanmar and Cambodia lie between these extremes: they have a very small number of comparatively well-established investment managers, with five to 10 years’ track record, but the sector is still relatively small. In all countries, stock markets are relatively underdeveloped compared to the financial systems in each country, particularly in small-cap exchanges. Because it is unlikely that founding investors can take the standard exit route when a company lists, this further prevents investors from entering countries with an already-weak supply of risk capital.

Experienced investors in these markets note that the quality of entrepreneurs and SMEs has improved dramatically, albeit from a very low base, and at least for the domestic-based investors, pipeline development is becoming easier.

Related posts include characteristics of SMEs’ in the Mekong, as well as their use of financial products. We also examine obstacles faced by SMEs in the Mekong countries. A comparison of Gazelles in Myanmar and Cambodia can be found here.

[1] Vietnam has also attracted significant interest from global and regional private equity firms, however this is not directly relevant to ‘small and medium enterprises’.

[2] Of the 783 bank branches, 420 belong to ACLEDA and Sathapana, both of which used to be MFIs.

Comments are closed.