Why is access to finance a problem for water suppliers?

Profitable businesses frequently lack access to finance to grow, whether that be investing in productive assets (fixed assets), or financing working capital and supply chains (inventory). Businesses in Cambodia, as in many other countries, find access to debt finance particularly difficult, as they lack appropriate collateral to secure the loan, and banks lack the capacity to analyse the investment opportunity.

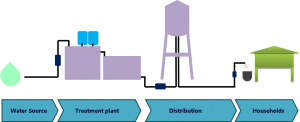

Here we present a case study of a 2014-15 project we undertook with GRET in the piped water industry, to help Cambodian piped water suppliers and banks negotiate improved debt finance to expand network coverage, and therefore Cambodians’ access to safe, piped water.

The project did not use direct grant subsidy to fund operators’ investment – that’s an expensive and short-term solution to inefficient lending practices. Rather, we focused on how well-constructed investment analysis could influence banks’ credit decisions.

This first blog post explains the problem and why these businesses should have better access to capital. Our second post details the financial modelling aspects, and how we worked with businesses and banks to overcome the challenges. A more detailed description of our work and its success is in this World Bank report.

In 2015 there were 145 licensed Domestic Private Water Operators (DPWOs) in Cambodia, providing piped water to households and businesses throughout the country. Most were profitable, had solid track records and were run by able management. However, their infrastructure was operating at or close to full capacity. At the same time, less than half of households within many of their supply areas were connected to their networks. This was despite piped water being affordable for most. Additional investment was required to increase capacity and reach unserved households.

However, many piped water suppliers faced difficulties in obtaining sufficient credit from banks. Around half of piped water suppliers surveyed had accessed a commercial loan, but most were only able to borrow a fraction of what they required for capital investment.

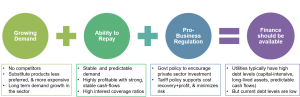

This was despite growing demand, a strong ability to service debt and a favourable regulatory environment, as detailed in the diagram below.

Growing demand

Within its licensed area, a DPWO faces little competition. It has a monopoly license for that area. No one else can legally build a competing network.[1] Furthermore, alternative sources of water struggle to compete on price with DPWOs. The price households pay for piped water is low compared to other substitute services (see figure below). Surveys reveal that piped water is preferred to alternatives, even among poor households.

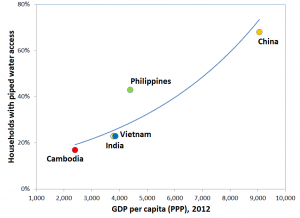

DPWO water connections grew at approximately 20% per annum from 2008 to 2012. Considerable further growth was expected, as Cambodia’s economy continued to develop (see Figure below), incomes rose and more people lived in urban environments. JICA estimated that the number of urban communes in Cambodia will increase from 162 in 2008 to 813 by 2025, driving requirements for piped water systems.

DPWO water connections grew at approximately 20% per annum from 2008 to 2012. Considerable further growth was expected, as Cambodia’s economy continued to develop (see Figure below), incomes rose and more people lived in urban environments. JICA estimated that the number of urban communes in Cambodia will increase from 162 in 2008 to 813 by 2025, driving requirements for piped water systems.

More than 75% of operators by WSP Cambodia in 2013 said they planned or needed to invest in the near future, mostly because of customer demand[2]. Furthermore, half of the businesses surveyed were interested in running an additional site — that is, expanding into a new area.

Ability to repay

Like most utilities, the demand for DPWO services is relatively stable and predictable. They are capital-intensive businesses – depreciation is a high proportion of total costs (see table below), and cost of sales is very low. Hence the businesses have cash flow is stronger than other types of businesses.

Importantly, this revenue has historically been secure – no private DPWOs in Cambodia had gone bankrupt or had their license renewal withheld.

Importantly, this revenue has historically been secure – no private DPWOs in Cambodia had gone bankrupt or had their license renewal withheld.

Furthermore, the returns on marginal network expansion in a licensed area are potentially more profitable; more customers within an area means that fixed costs (intake, treatment and storage facilities) are shared across more customers, lowering the average cost per customer.[3]

Pro-business Regulation

Because of their monopoly, DPWOs are regulated. The policy of the Cambodian government is to promote expansion of piped water supply, primarily through private sector investment. At the time of our project, the government aimed to encourage long term profitability and access to investment, through extensions of the license period and changes to the tariff setting mechanism.

Tariffs charged by DPWOs were nominally regulated. The government objective was for an “appropriate tariff that can promote both economic efficiency in the use of water resources and financial sustainability of water supply service providers.” Hence the government implicitly underwrites the piped water supply operators (provided they are efficient and meet standards). In practice the Ministry is constrained and only around 30% of licensed DPWO had their tariffs set by government. For the rest, tariffs were determined by negotiation between the supplier and customers, with some intervention from local authorities.

Access to finance shouldn’t be a problem for piped water suppliers

Utilities typically have debt levels that are higher than other businesses (they are capital-intensive, with long-lived assets and predictable cash flows). Regulators in developed economies often assume a ratio of debt to debt-plus-equity of 60% when setting tariffs. Any regulated business with lower gearing than this would be “leaving money on the table”.

However, in 2015 debt levels of Cambodian DPWOs were low. Only 16% of financing came from the banking sector, compared to 76% from personal or family sources.

One particular barrier was banks’ insistence on only lending against collateral – and that collateral usually must be real estate. Banks appeared to ignore DPWOs’ network assets and their cash flows.

We argued that banks’ lending policies needed to acknowledge that DPWOs are not like other businesses and therefore should recognize:

- Water production, storage and distribution systems are valuable assets — that can be used as collateral;

- These assets have long lives – debt maturities should reflect this;

- Revenues are relatively secure and predictable, are protected from competition and somewhat insulated from the normal business cycle. These strong cash flows could be a basis for commercial lending; and

- Additional customers are more profitable due to high fixed costs.

Our next post (here) details how we worked with DPWOs and banks to improve their access to finance.

1] The cost structure of network businesses such as utilities (decreasing long-run average costs) means that they are what economists call a “natural monopoly”: it is more efficient to have a single provider than multiple providers within a geographic area.

[2] Frenoux C., Carlier R., Lecorre M., Yi S., Tsitsikalis A., 2013. “Global Study for the Expansion of Domestic Private Sector Participation in the Water and Sanitation Market – Cambodia” WSP, Phnom Penh

[3] Under a fully regulated model, larger operators tend to have lower average tariffs and so cost savings would be eventually passed to customers in the form of lower tariffs.

Other relevant EMC blog posts include:

Borrowing capacity of Cambodian businesses

The financing gap faced by SMEs

Comments are closed.